On the southern edge of Brussels, where the city turns to suburbs, the future of Germany’s most successful automaker is taking shape inside a peculiar sort of car factory. Here, there are no exhaust pipes, transmissions or fuel tanks. There are no spark plugs, radiators or manifolds. What the Volkswagen Group factory does have, however, are batteries stacked to the rafters.

Thirty-six shoebox-sized battery modules, each containing a dozen lithium-ion cells, are packed into seven-foot long electric-battery packs and slung under the floor of each sport utility vehicle produced here. The first electric SUV from Volkswagen’s luxury Audi brand, the e-tron, can go 400 kilometers (nearly 250 miles) on a single battery cycle and be recharged in as little as half an hour. The styling is conventional, the interior is luxurious and the ride is nearly silent.

The e-tron SUV has one job for Volkswagen: Prove that a carmaker that has relied almost exclusively on the internal combustion engine since it was founded 82 years ago can produce electric vehicles people want to buy and policymakers will embrace as they cast around for ways to tackle the climate crisis. Success means that Volkswagen will overtake rivals, including Tesla, in electric car sales and fend off new challengers from China and Silicon Valley; failure could signal the beginning of the end for a company with 665,000 employees and annual revenue of $265 billion.

Battery packs are assembled inside Audi’s e-tron factory in Brussels. – Credit: Stefan Warter/AUDI AG

Battery packs are assembled inside Audi’s e-tron factory in Brussels. – Credit: Stefan Warter/AUDI AG

Volkswagen isn’t alone. Established carmakers around the world are ripping up their business models in the hope of adapting to a new world in which electricity replaces gasoline and diesel. Factories are being overhauled to produce electric cars, and automakers are snapping up every battery they can find. The high cost of developing electric cars is forcing some companies to find partners and turning others into acquisition targets. The need to meet strict emissions standards in China and Europe means that executives are paying far more attention to the policies being put in place in Beijing or Brussels, than what rivals are building in Detroit or Wolfsburg, Volkswagen’s hometown.

The German group, which also owns Porsche, Bugatti, Skoda, Lamborghini and SEAT, is rising to the challenge with a radical transformation that is unparalleled since World War II. The company is spending €30 billion ($34 billion) over the next five years to make an electric or hybrid version of every vehicle in its lineup, and it plans to launch 70 new electric models by 2028. By the end of 2030, it wants four of every 10 cars it sells to be electric, a mass market play that hinges on the success of a new line of vehicles called the “ID.”

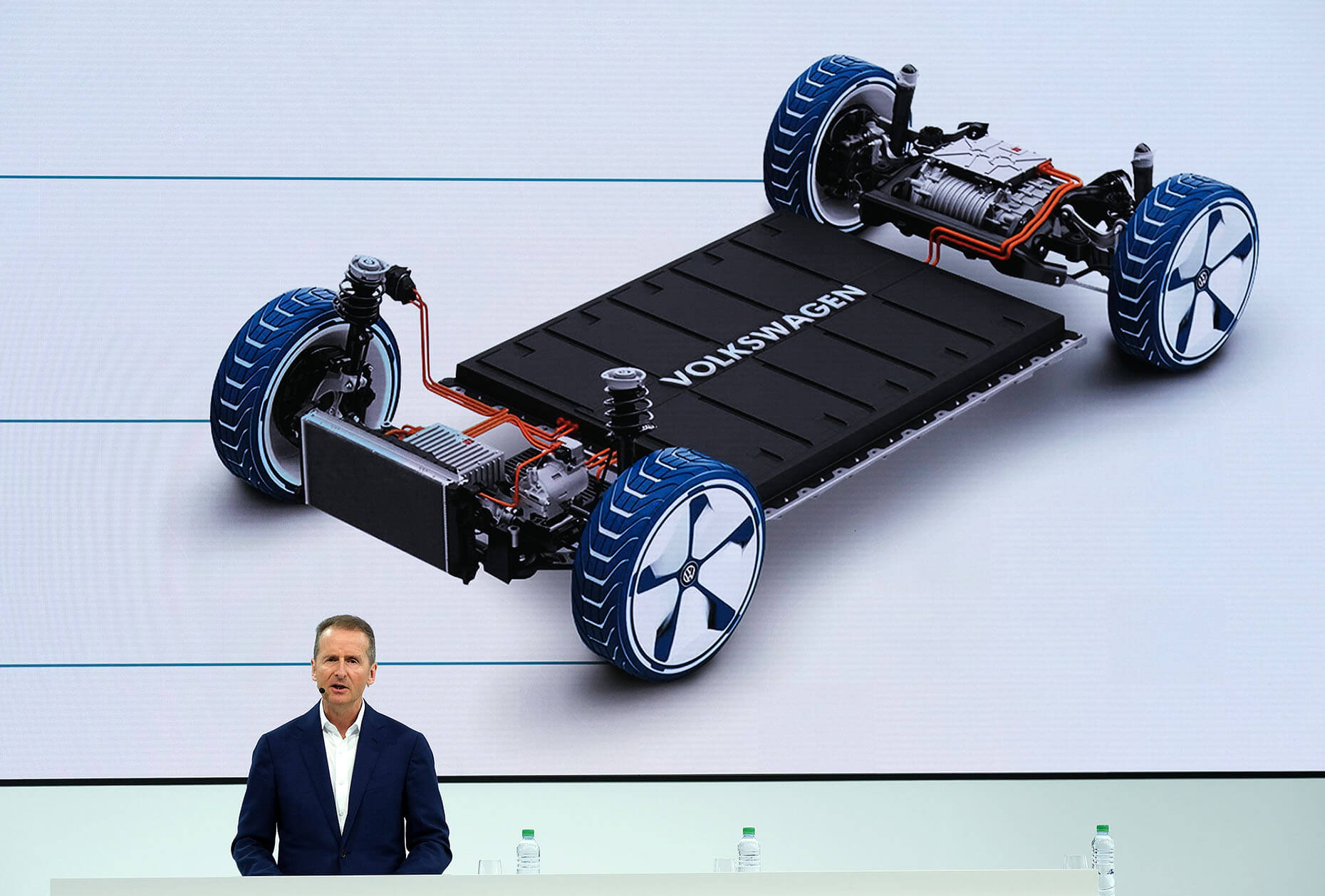

The overhaul has profound implications for the world’s largest carmaker as it tries to turn the page on its costly diesel emissions scandal. Volkswagen is spending billions of dollars to retrofit factories from Germany to China to produce cars based on its modular electric car production platform, or MEB. The company has also signaled that it will use some of the money it makes from selling fuel-powered cars to produce its own batteries and build charging networks.

The initiatives are expensive. But the level of investment by Volkswagen and its competitors, coupled with the aggressive emissions targets set by regulators, show there’s no turning back. All of this leads to a new question: Can Tesla maintain its lead in the global race to the electric car?

The e-tron on display at Volkswagen’s 2019 shareholders’ meeting in Berlin, Germany. – Credit: Carsten Koall/Getty Images

The e-tron on display at Volkswagen’s 2019 shareholders’ meeting in Berlin, Germany. – Credit: Carsten Koall/Getty Images

History isn’t the best indicator of who will emerge from this battle victorious. The industry has a poor track record with electric cars. General Motors’ EV1 appeared on American roads in 1996, the same year the auto industry successfully lobbied against a mandate from the California Air Resources Board to make more electric vehicles. The model was canceled in 2003, producing a trail of unhappy customers and the conspiratorial documentary ‘Who Killed The Electric Car?’ Chevrolet pulled the plug on the Volt, which never sold in significant numbers, last year. Nissan’s Leaf remains in production but it has failed to achieve the level of commercial success envisioned by the company’s former chairman, Carlos Ghosn. More broadly, demand has been hampered by fears over the driving range of the cars, a lack of charging infrastructure and high sticker prices.

An EV-1 pictured in California in 1997. The EV1 was a pioneering electric car, but it failed to attract many drivers. – Credit: John B. Carnett/Bonnier Corp. via Getty Images

An EV-1 pictured in California in 1997. The EV1 was a pioneering electric car, but it failed to attract many drivers. – Credit: John B. Carnett/Bonnier Corp. via Getty Images

Until recently, Volkswagen never had much reason to bother with electric cars. Instead, it poured investment dollars into making its diesel engines more fuel efficient and affordable, which helped it to sell huge volumes of cars and overtake Japanese rival Toyota. In 2018, Volkswagen delivered a record 10.8 million cars. It says just 40,000 of those, or 0.4%, were electric vehicles. Another 60,000 were plug-in hybrids. Global sales of electric cars have been only slightly less anemic: 1.3 million of the roughly 95 million cars sold around the world in 2018 were battery electrics, according to the consultancy LMC Automotive.

Disinterest on the part of traditional carmakers cleared the way for the opening laps of the race to be won by Tesla, the company run by indefatigable entrepreneur Elon Musk. Tesla sold over 220,000 electric cars in 2018, according to LMC Automotive, roughly 70,000 more than its nearest competitor, Chinese state-owned BAIC Group. The global alliance of Renault, Nissan and Mitsubishi Motors sold roughly 130,000 electrics last year, while Volkswagen’s German rivals BMW and Daimler sold 33,000 and 14,400, respectively. At the bottom of the heap was Toyota, the world’s second largest carmaker, which has chosen to focus on hybrid cars and fuel cell technology. It sold only 1,000 electric vehicles last year, an increase from zero in 2017. LMC, whose data does not include sales in South America, Canada and Mexico, or commercial vans, has Volkswagen selling 26,000 electrics.

Tesla CEO Elon Musk unveils the Tesla ‘D’ model in Hawthorne, California in October 2014. Musk has turned Tesla into the global leader in electric car sales. – Credit: Kevork Djansezian/Getty Images

Tesla CEO Elon Musk unveils the Tesla ‘D’ model in Hawthorne, California in October 2014. Musk has turned Tesla into the global leader in electric car sales. – Credit: Kevork Djansezian/Getty Images

While the electric car has a checkered past, there is a consensus among auto industry executives and analysts that a tipping point is approaching where mass adoption will become unavoidable because of falling battery costs, pressure from regulators and generous government subsidies. “These factors have come together to force the traditional industry to take electrification seriously — faster than we had previously expected,” said Max Warburton, an analyst at research firm Bernstein. “This is now really happening.”

According to Bernstein, dramatic declines in the price of batteries will allow leading automakers to sell fully electric vehicles for less than cars powered by gasoline and diesel as soon as 2022. Electric cars, they argue, are already gaining traction: As recently as 2010, annual sales were close to zero. “There’s just such an incredible amount of money being poured into electric cars,” said Al Bedwell, the director of global powertrain at LMC Automotive.”I’ve been looking at this industry for 20 years, and my real gut feeling is that it’s kind of unstoppable now.”

Bedwell said that traditional carmakers are being prodded to move more quickly by two additional factors: strict new EU regulations that require auto manufacturers to dramatically reduce the CO2 emissions starting next year. And, in China, already the world’s largest market for electric cars, the government has implemented a system that requires carmakers to make clean vehicles or purchase credits for the CO2 emissions their cars produce.

Greenpeace activists demonstrate at the Volkswagen plant in Wolfsburg, Germany, in November 2015. Volkswagen is still dealing with fallout from its 2015 emissions scandal. – Credit: John MacDougall/AFP/Getty Images

Greenpeace activists demonstrate at the Volkswagen plant in Wolfsburg, Germany, in November 2015. Volkswagen is still dealing with fallout from its 2015 emissions scandal. – Credit: John MacDougall/AFP/Getty Images

Volkswagen, which has paid more than $30 billion in penalties since admitting in 2015 to rigging the emissions of millions of diesel cars, has embraced electrics with the enthusiasm of a religious convert. “Volkswagen will change radically,” CEO Herbert Diess told shareholders in March. “Some of you may still be rubbing your eyes in amazement. But, make no mistake — the supertanker is picking up speed.”

While the company has telegraphed its mass market ambitions for electric cars, its luxury brands are taking the lead. The first fully electric Porsche, the Taycan, is scheduled to go on sale later this year. Audi, meanwhile, plans to offer 12 purely electric models by 2025. The brand brought only electrified vehicles to this year’s Geneva Motor Show, including a compact SUV that is expected to enter production by the end of 2020. The success of these early luxury models is vital: Volkswagen produces over 10 million vehicles each year but relies on selling 2 million Audis and Porsches for 65% of its profit.

Volkswagen CEO Herbert Diess speaks at the company’s headquarters in Wolfsburg, Germany in March. Diess is betting the company’s future on the MEB, or modular car platform. – Credit: Sean Gallup/Getty Images

Volkswagen CEO Herbert Diess speaks at the company’s headquarters in Wolfsburg, Germany in March. Diess is betting the company’s future on the MEB, or modular car platform. – Credit: Sean Gallup/Getty Images

The man charged with making Audi electric vehicles a success is Stefan Niemand, the brand’s head of electrification. In an interview at Audi headquarters in the Bavarian city of Ingolstadt, the barrel-chested executive argued that the company is well prepared for its electric future. The next generation of electric vehicles, he says, will be cheaper and packed with technology that customers want. “We learned a lot with the e-tron battery system, the crash system, the cooling system, the connection system and all this stuff. And of course, we now better understand where we can bring costs down, where we can optimize the system, where we can gain range or performance.”

E-tron battery systems under construction in Brussels – Credit: Audi

The most important question is whether customers will respond to vehicles like the e-tron. “I think we did all that we can. We made the first car, and I think for the first car, it’s very, very good,” says Niemand.

Pressed on whether consumers are ready to adopt electric vehicles en masse, Niemand thinks back to his first experience with the R8 e-tron, an electric version of the Audi 2-seat sports car that has been tested in various forms since at least 2010. Before driving the car, a professional driver warned the executive that it would be much faster than he expected. Niemand said he thought the driver was joking. “Then I pushed the throttle, and … I knew, forget about everything else.”

His experience left him in no doubt: “This is the future.”

Top electric car manufacturers in 2025

Sales figures for the future industry leaders

20,000

40,000

60,000

80,000

100,000

120,000

160,000

200,000

240,000

250,000

500,000

750,000

1,000,000

1,250,000

1,500,000

Renault-Nissan-Mitsubishi

Source: LMC Automotive.

LMC sales and projections do not include South America, Canada and Mexico, or commercial vans.

2015

Nissan, which makes the Leaf, combines with alliance partner Renault to lead global carmakers in electric car sales.

2016

Tesla gains ground on Renault and Nissan, which remain atop the charts. Volkswagen’s sales of electric cars drop to just over 13,000.

2017

Nissan and Renault lose the electric car crown to Tesla, which sells almost 100,000 vehicles in 2017.

2018

Tesla is firmly in the lead. It sells nearly 222,000 cars as Model 3 production gains momentum.

2025

Volkswagen leads all carmakers with over 1.4 million sales. Renault-Nissan and China’s Geely have also overtaken Tesla.

If the hearts and minds of die-hard speed freaks can be won, the question for Audi is how to gain an advantage over Tesla, which has become synonymous with electric cars and competes for the same luxury customers as the German brand. For Niemand, the answer lies in doing what Audi has done for more than 100 years: build cars that people want to drive. “This is what we’re really, really good at,” he said. “That’s the advantage. If you compare the e-tron to other fully electric cars from newcomers, then you see the knowledge that we have in building cars. I think customers will respect this.”

The e-tron is the first electric SUV from Audi – Credit: Audi

Niemand acknowledges that there are things Audi can learn from Tesla, especially when it comes to the speed of innovation. But when it comes to production, he said that Audi has a major advantage. “Mr. Musk talked about the production hell,” he said, referring to comments the Tesla CEO made in 2017. “This is where we have much more experience and knowledge. With the launch of the e-tron, we were not in the production hell, and we are still not, and we will not get into any kind of production hell.” Niemand is more dismissive of attempts by tech companies like Uber, Google and Apple to break into the auto business. “If you look at all the autonomous driving efforts from Uber and Google and Apple, and if you see the outcome up to now, it’s close to nothing. Why? Because it is still about a car.”

Tesla has one major advantage over its more traditional competitors: No baggage. The American upstart doesn’t have a big dealership network, entrenched unions or a legacy business to manage. “It’s a very costly exercise for traditional carmakers to get into the electric vehicle space in a big way,” said Bedwell, the LMC Automotive analyst. “At the same time, they’ve got to support all of their conventional activities. That’s where most of their revenue is. Volkswagen, for instance, can’t stop selling internal combustion engine cars. It can’t stop selling diesel cars in Europe.”

The urgent need to free up cash for new technology is causing automakers to find partners to share the costs. BMW and Daimler, which compete hard in the luxury market, have announced a partnership focused on highly-automated and autonomous driving. They’re also investing $1 billion in a new venture to develop mobility services, including ride-sharing and charging systems for electric cars. Ford will build vehicles using Volkswagen’s electric platform under a deal announced in July. Volkswagen will meanwhile join its US rival in investing in Argo AI, an autonomous vehicle company valued at $7 billion. More dramatic changes are under consideration. In May, Fiat Chrysler proposed a merger with Renault that would have created the world’s third largest carmaker and produced annual cost savings of more than €5 billion ($5.6 billion). When the proposal was withdrawn, Renault lamented the lost opportunity, saying the merger had “great financial merit” and “compelling industrial logic.”

At a press conference in July, Volkswagen CEO Herbert Diess and Jim Hackett, the CEO of Ford, announced they will work together on electric cars. – Credit: Johannes Eisele/AFP/Getty Images

At a press conference in July, Volkswagen CEO Herbert Diess and Jim Hackett, the CEO of Ford, announced they will work together on electric cars. – Credit: Johannes Eisele/AFP/Getty Images

The survival of some of the world’s most storied car brands hangs in the balance. According to LMC Automotive’s forecast, the huge amount of investment being deployed by Volkswagen will help it sell over 1.4 million electric cars a year by 2025 — more than any other carmaker and over three times the sales Tesla is expected to produce. The alliance of Renault, Nissan and Mitsubishi Motors is on track to rank second in 2025, selling nearly 590,000 electric vehicles that year. China’s Geely, which owns Volvo, will rank third. Tesla will be fourth with 413,000 vehicles, followed closely by Toyota. Daimler, Hyundai, General Motors and Ford are each forecast to sell between 330,000 and 400,000 cars in 2025.

“If you look at all the autonomous driving efforts from Uber and Google and Apple, and if you see the outcome up to now, it’s close to nothing. Why? Because it is still about a car.”

Bedwell said that Volkswagen’s resources and expertise will help it power past Tesla, which will face intense new competition for luxury car buyers and could continue to experience growing pains that inhibit its ability to scale up production dramatically. “They just have that position,” Bedwell said of Volkswagen, “to ship those kind of volumes and to produce them more efficiently than Tesla can and to make money on it.”

The entire industry is gearing up for the challenge. Ford CEO Jim Hackett recently told CNN Business that building cars is not just about technology. “We have to have an industrial model. Ford is really good at this,” he said. And he took a shot at Musk, who is also the CEO of spacecraft company SpaceX. “I happen to compete with a rocket scientist who’s really smart, and I respect that about him,” Hackett said. “And yeah, he’s competing with the ultimate disruptor in Henry Ford.”

Electric and hybrid Volkswagen cars are moved on elevated platforms at a factory in Wolfsburg, Germany in April 2016. – Credit: Krisztian Bocsi/Bloomberg via Getty Images

Electric and hybrid Volkswagen cars are moved on elevated platforms at a factory in Wolfsburg, Germany in April 2016. – Credit: Krisztian Bocsi/Bloomberg via Getty Images

For now, however, Tesla has the advantage. The company expects to deliver between 360,000 and 400,000 vehicles this year. It says production could increase to 500,000 in the 12 months to June 30, 2020, depending on how quickly a new factory in Shanghai comes online. And leaks suggest that the Porsche Taycan, which is often described as a “Tesla killer,” won’t live up to those expectations. According to analysts at UBS, the car will take a half second more than the Tesla S Performance model to go from zero to 100 kilometers per hour. The Porsche also won’t have the range of the Model S.

Porsche says performance is about more than raw speed. Taycan buyers will get better craftsmanship and materials, but they’ll be paying more too. The car is expected to sell for at least €90,000 ($100,000) in Germany, and the Turbo version will cost upwards of €150,000 ($167,000) — that’s roughly €50,000 ($56,000) more than the souped up Model S. “We find it intriguing that not even a leading sports car producer could beat Tesla on key metrics,” said the UBS analysts.

Porsche’s electric Taycan sits on display in Stuttgart, Germany, in June 2018. The Taycan has been billed as a “Tesla Killer.”

Porsche’s electric Taycan sits on display in Stuttgart, Germany, in June 2018. The Taycan has been billed as a “Tesla Killer.”

Speaking a stone’s throw from a museum that is packed to the rafters with diesel and gasoline cars, Audi’s Niemand makes the case for radical change.

“Thirty years ago or 40 years ago, a diesel was a no-go engine. It had nearly no horsepower, it needed like one minute to pre-heat the system before you could start the engine, all this stuff. And then you see what diesel can do today, it’s a totally different story,” explained the executive. “The same I think is true for electric mobility. We have now [reached] a point where you can make cars like the e-tron that really meet the demands of a lot of customers. They are not perfect, but they are very good.”

Speaking in March as he unveiled the Model Y, Tesla CEO Musk said: “Our goal all along has been to try to get the rest of the car industry to go electric.”

Whoever comes out on top, Musk will soon get his wish.